INSURANCE

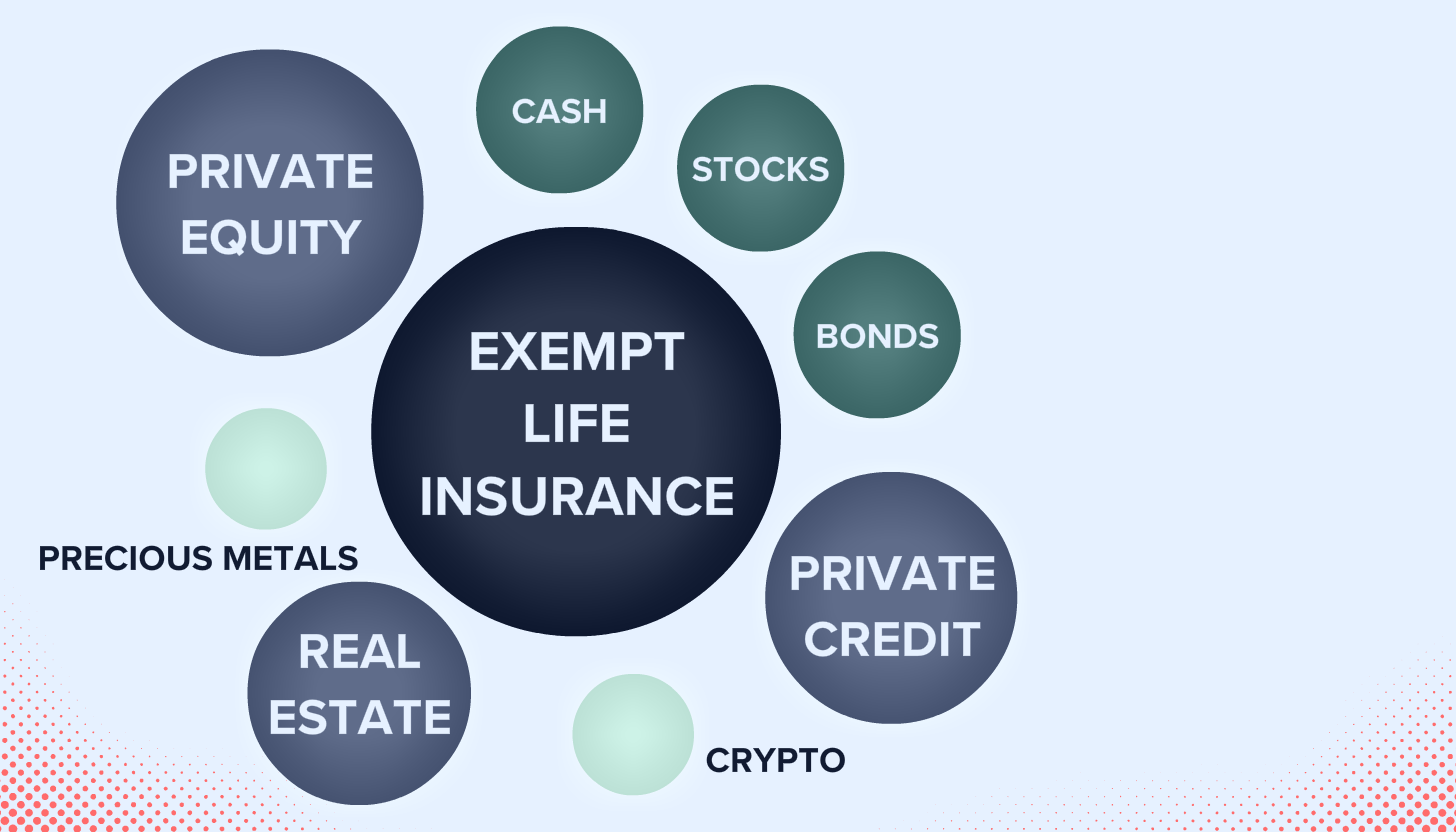

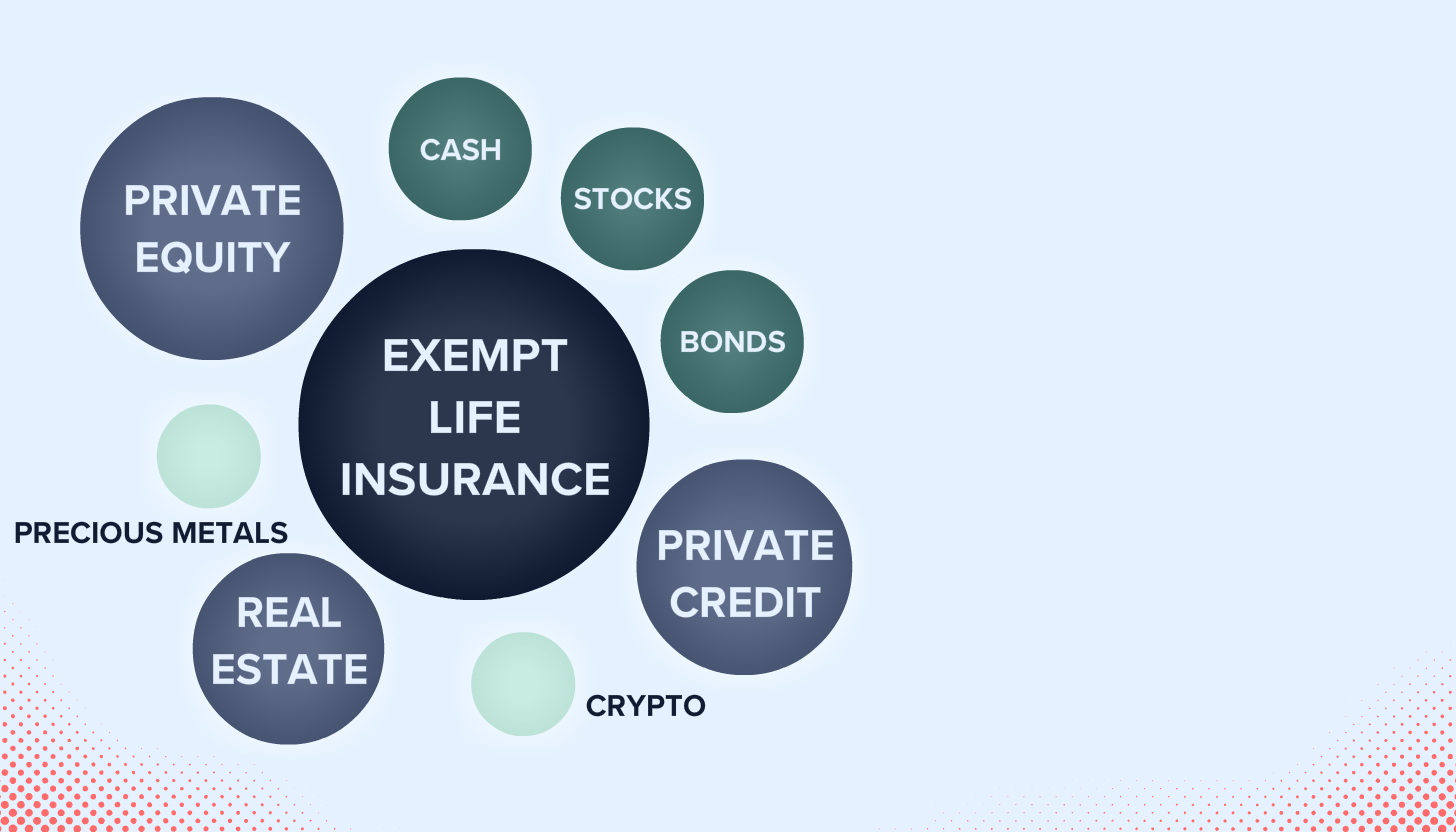

At Longevity, we elevate life insurance from a mere contingency plan to a central element in your wealth management strategy. Alongside other assets like investment accounts and real estate, life insurance stands as a powerful tool for wealth accumulation and transfer — a strategy extensively used by the world's wealthiest families.

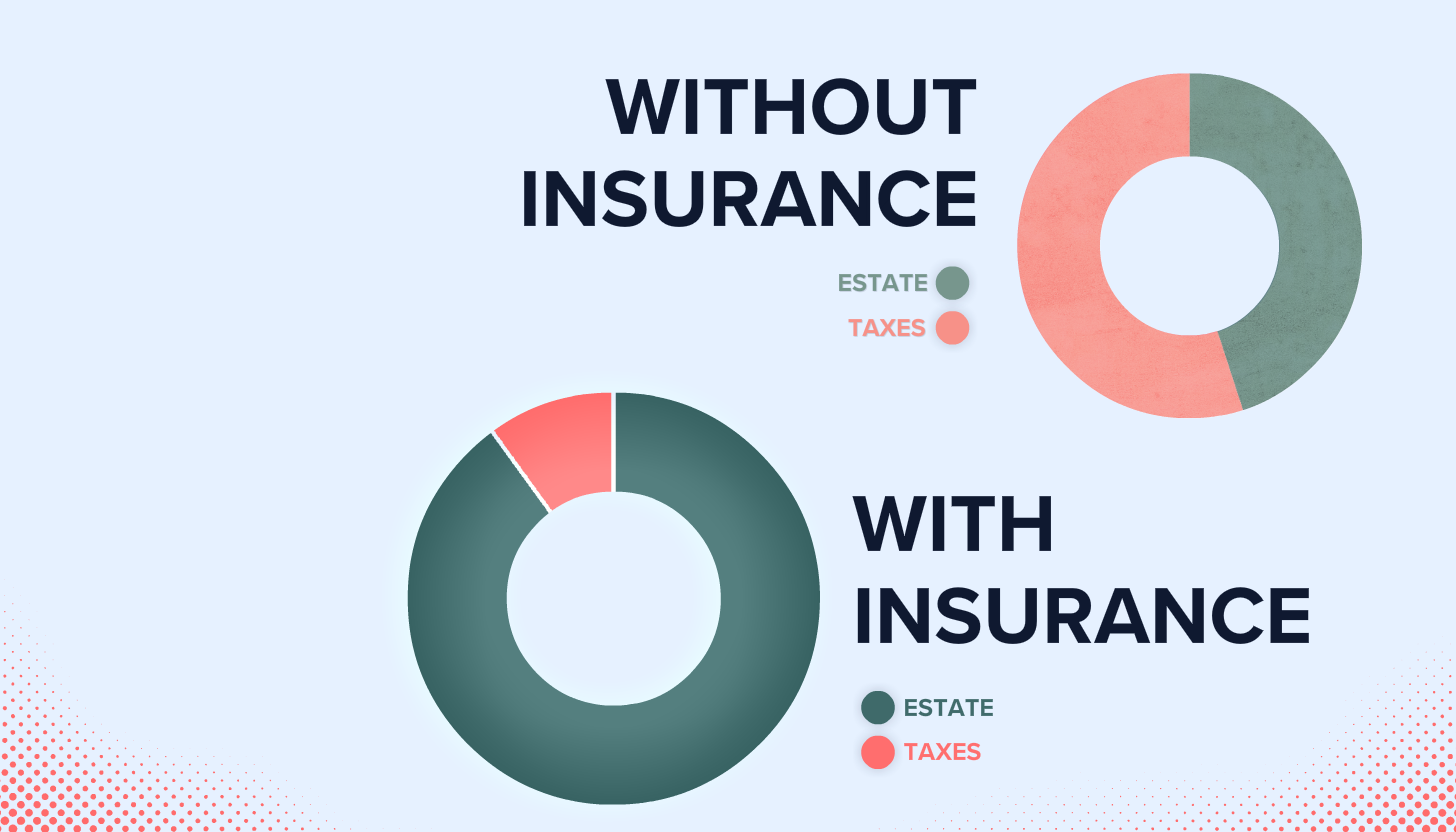

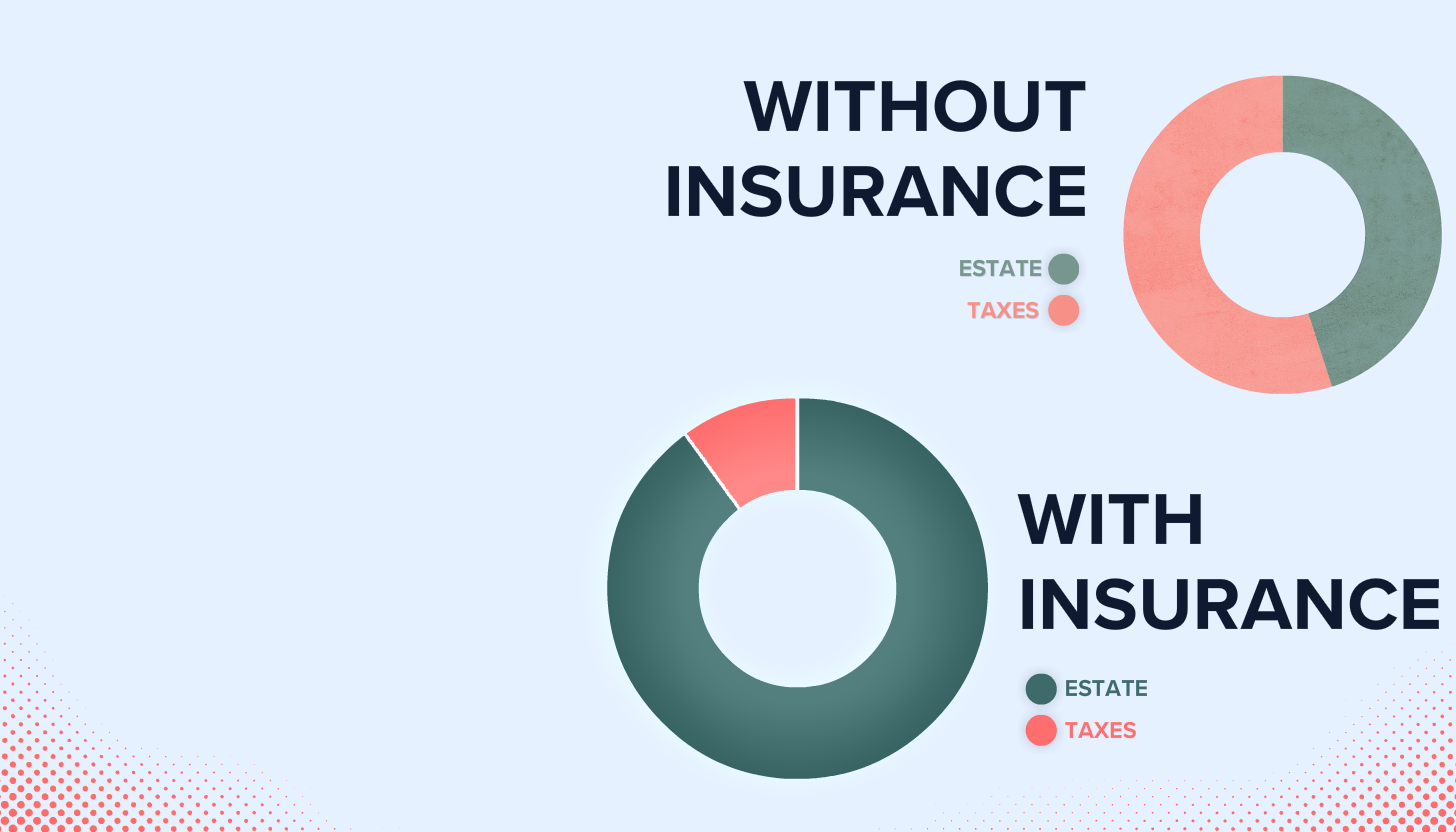

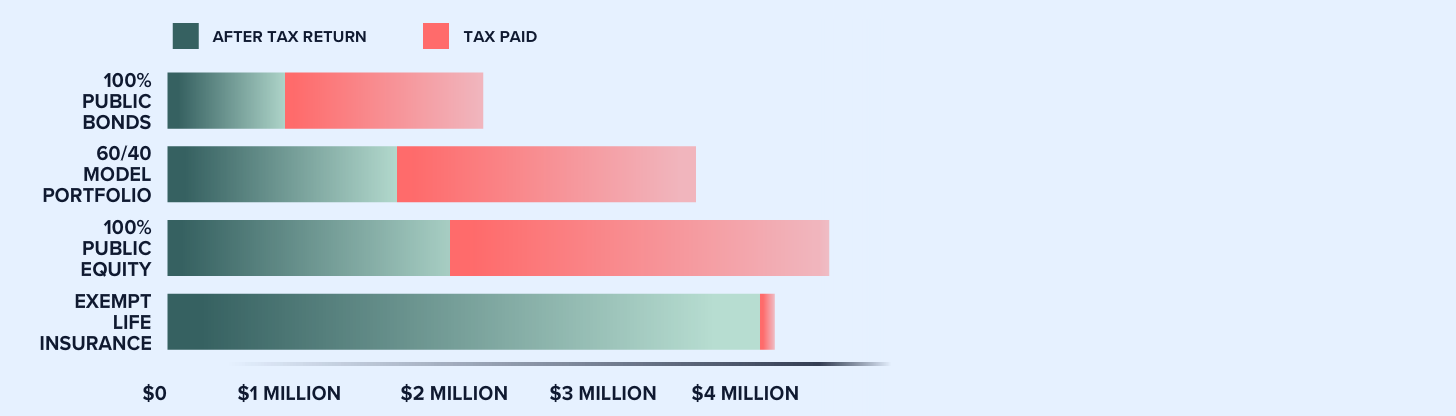

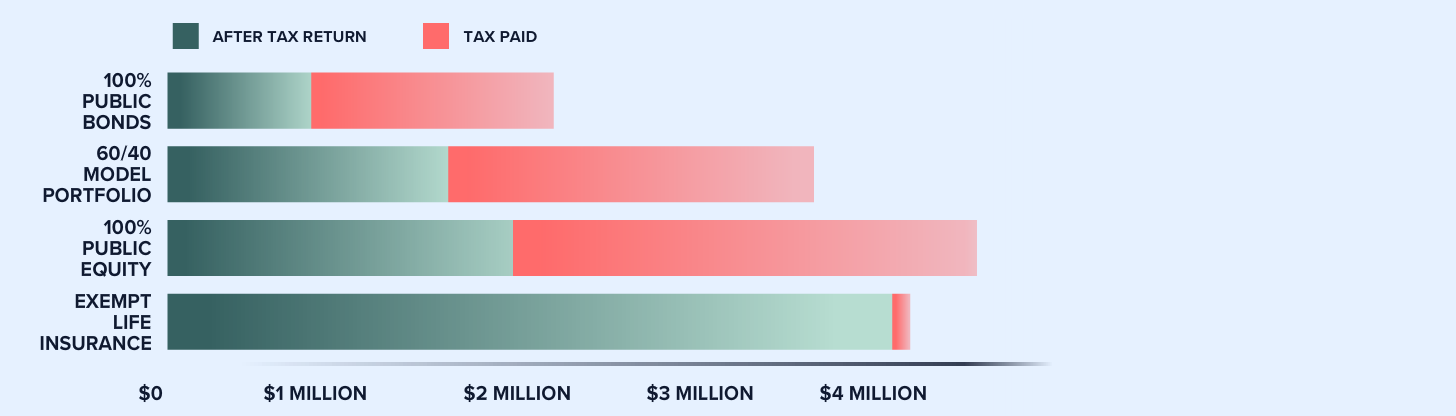

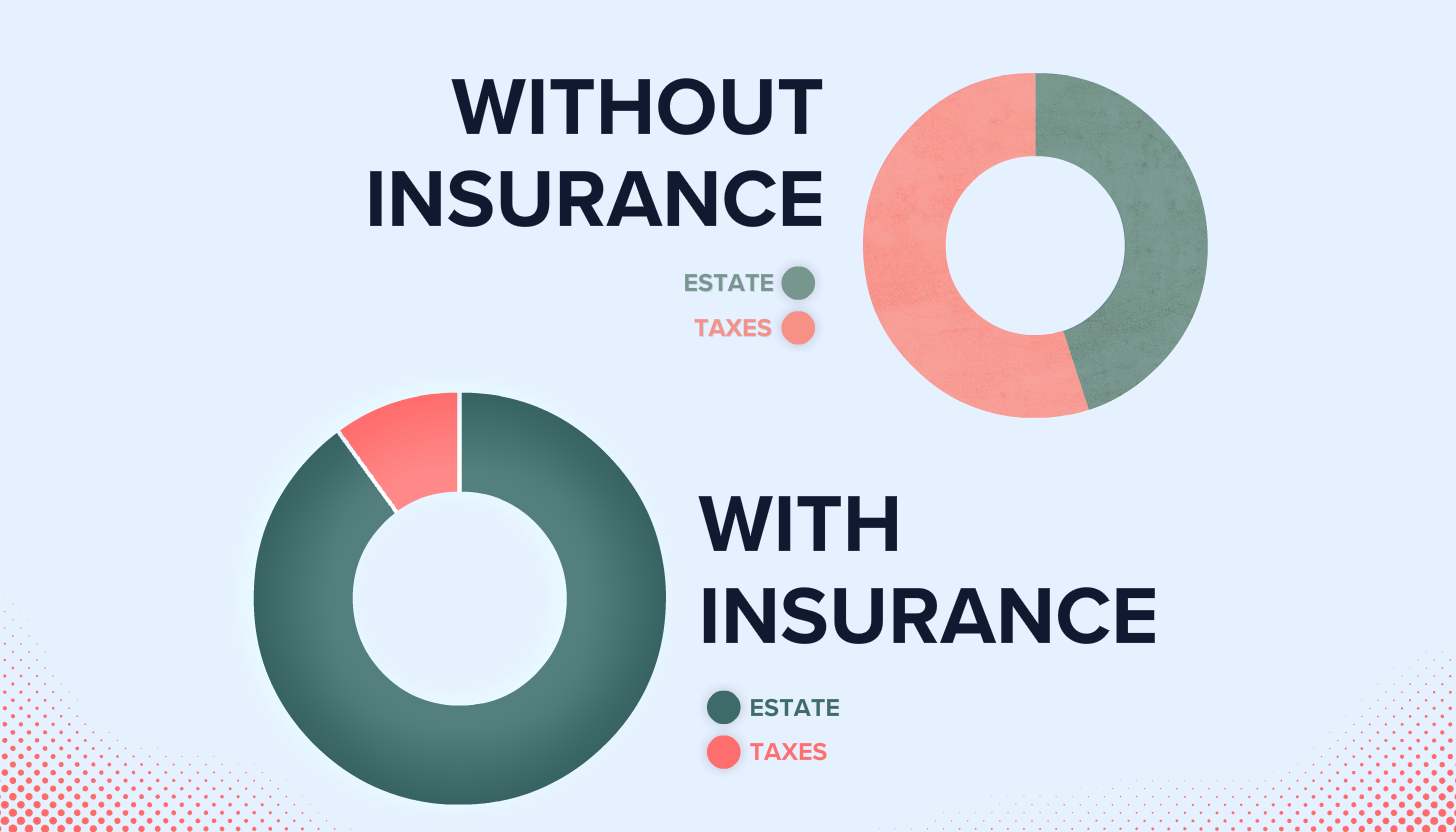

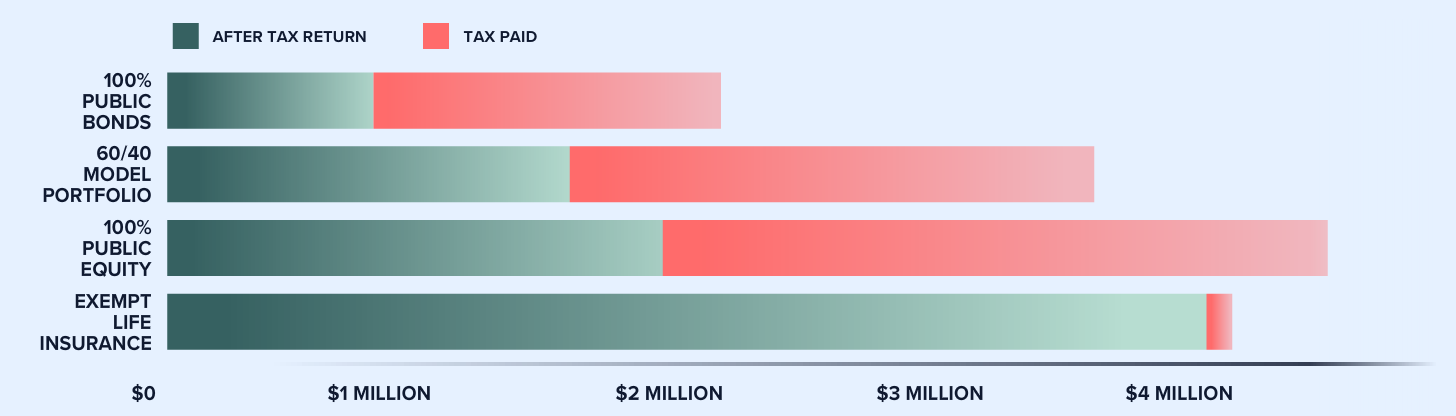

Life insurance, in our approach, is an asset class in its own right. After you've established a foundation with savings and investments, and you're leading a comfortable lifestyle, life insurance emerges as the next strategic haven. It allows you to safeguard your wealth, ensuring growth away from the grasp of taxation, and then seamlessly transfer it to your heirs, completely tax-free. This results in marked tax savings compared to traditional investment avenues.

The advantages are clear: not only does life insurance provide tax-efficient growth, but it also guarantees that gains are never negative. What you accumulate in your policy is secure and becomes a part of your lasting legacy.

At Longevity, we're transparent about the potential of life insurance. It's not just a part of your financial plan; it's an integral asset that complements and enhances your overall financial health and future legacy planning.

At Longevity, we elevate life insurance from a mere contingency plan to a central element in your wealth management strategy. Alongside other assets like investment accounts and real estate, life insurance stands as a powerful tool for wealth accumulation and transfer — a strategy extensively used by the world's wealthiest families.

Life insurance, in our approach, is an asset class in its own right. After you've established a foundation with savings and investments, and you're leading a comfortable lifestyle, life insurance emerges as the next strategic haven. It allows you to safeguard your wealth, ensuring growth away from the grasp of taxation, and then seamlessly transfer it to your heirs, completely tax-free. This results in marked tax savings compared to traditional investment avenues.

The advantages are clear: not only does life insurance provide tax-efficient growth, but it also guarantees that gains are never negative. What you accumulate in your policy is secure and becomes a part of your lasting legacy.

At Longevity, we're transparent about the potential of life insurance. It's not just a part of your financial plan; it's an integral asset that complements and enhances your overall financial health and future legacy planning.

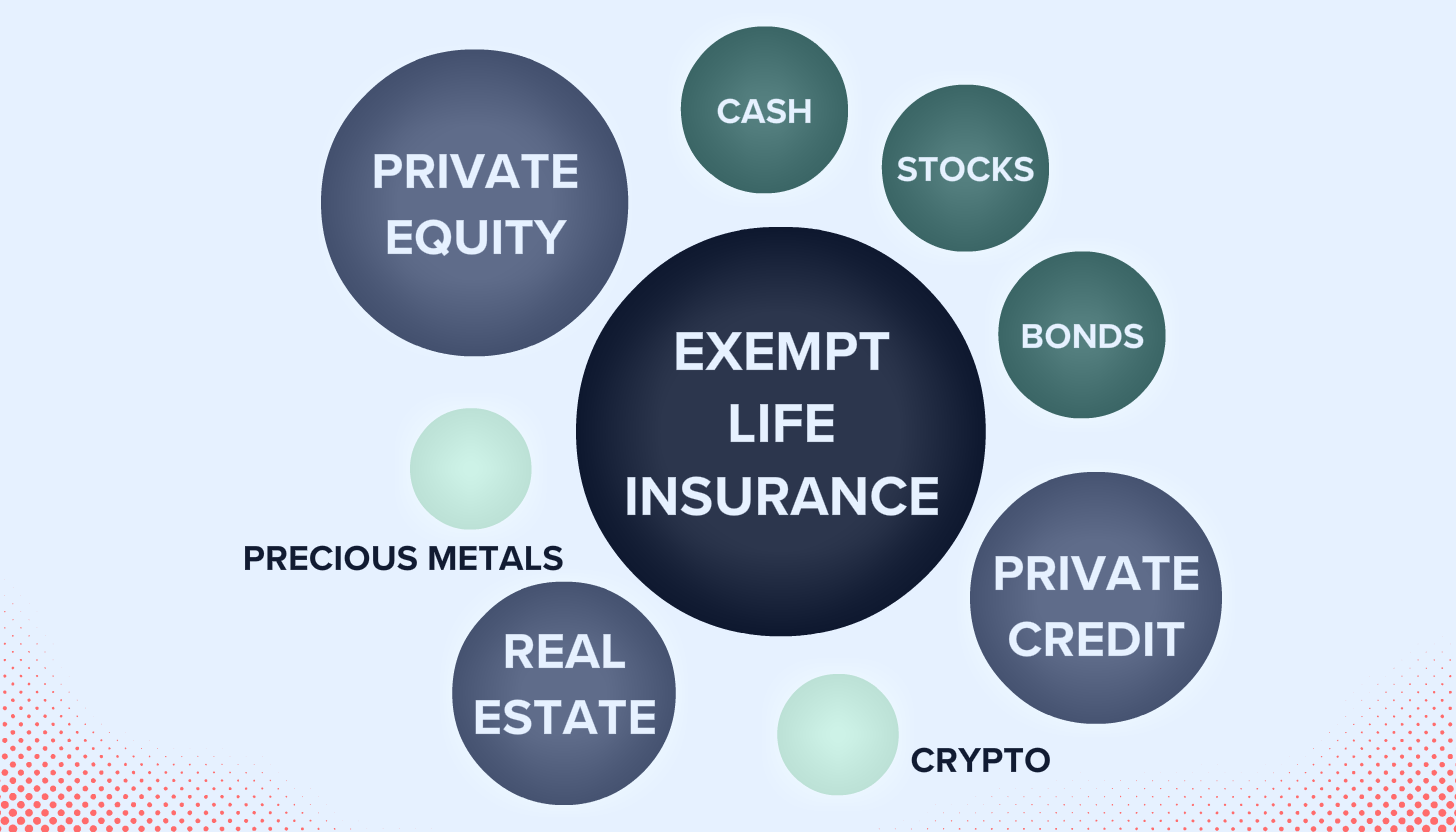

INSURANCE AS

AN ASSET CLASS

Insurance as an Asset Class at Longevity transforms life insurance into a core wealth management tool. More than a contingency plan, it's a powerful asset for wealth accumulation and tax-free transfer, used by the world's wealthiest. As part of your financial strategy, it safeguards your wealth from taxes and guarantees stable growth that can never be negative. Life insurance complements your savings and investments, securing your legacy and enhancing your financial health. At Longevity, we open the door to this strategic haven, ensuring your wealth not only grows but is passed on efficiently.

UNVEILING THE POWER OF PERMANENT LIFE INSURANCE

Tax-Free Growth

Your policy's cash value grows tax-free, providing a unique edge over other investment vehicles.

Guaranteed Growth

Vested returns ensure your investment only moves forward, never backward.

Accessible Wealth

Leveraging collateral loans, you can access your funds without interrupting the policy's growth.

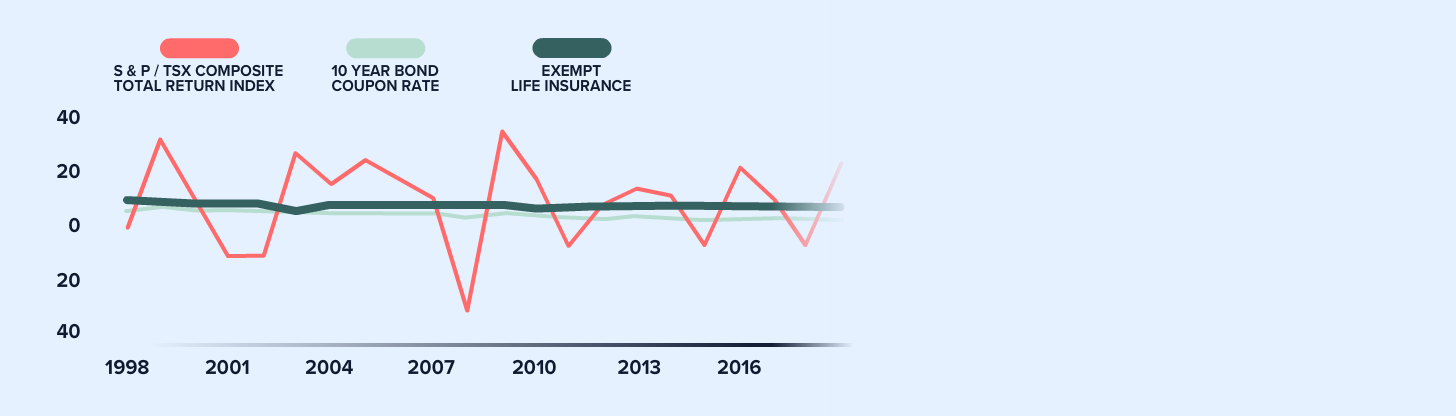

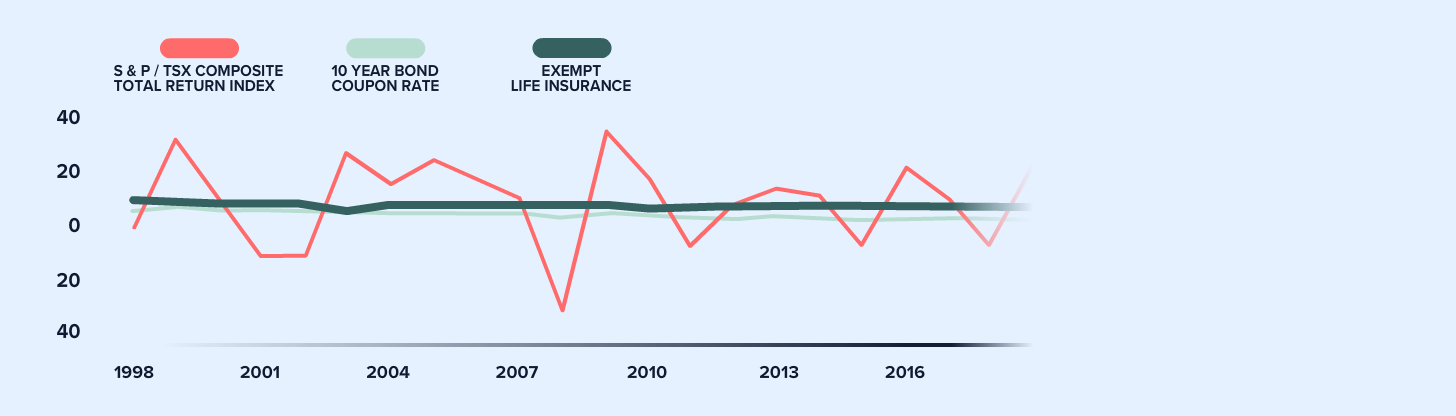

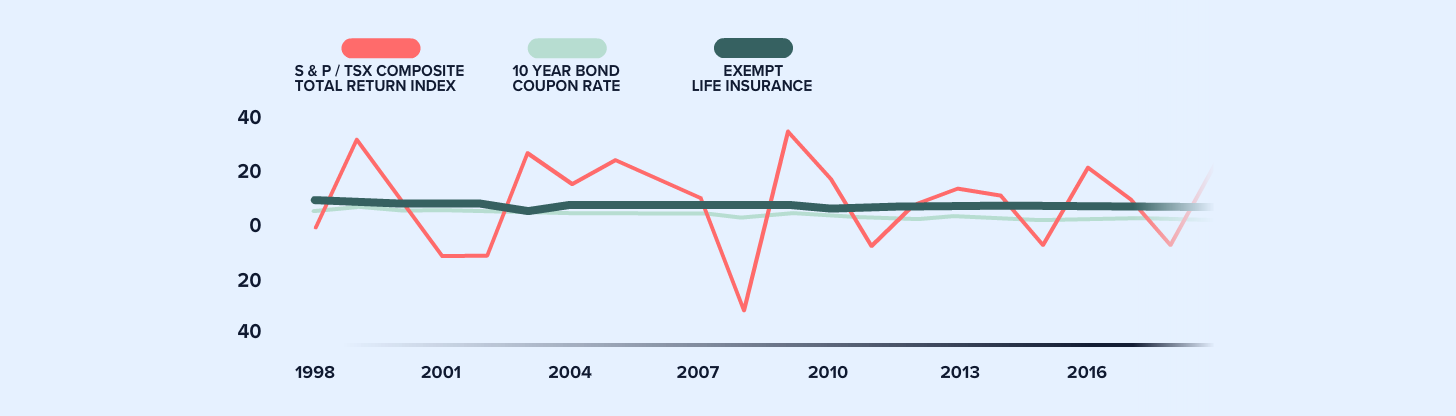

STABLE RETURNS

With smoothed returns, life insurance offers a dependable growth trajectory, free from market volatility.

CANADA'S LAST GREAT TAX HAVEN

In a landscape where almost every financial gain is taxed, life insurance emerges as a rare tool for tax-free growth and transfer. It stands alongside TFSAs and principal residence gains as a unique tax-efficient haven.