INVESTMENT MANAGEMENT

At Longevity, our approach to investing marks a clear departure from the past.

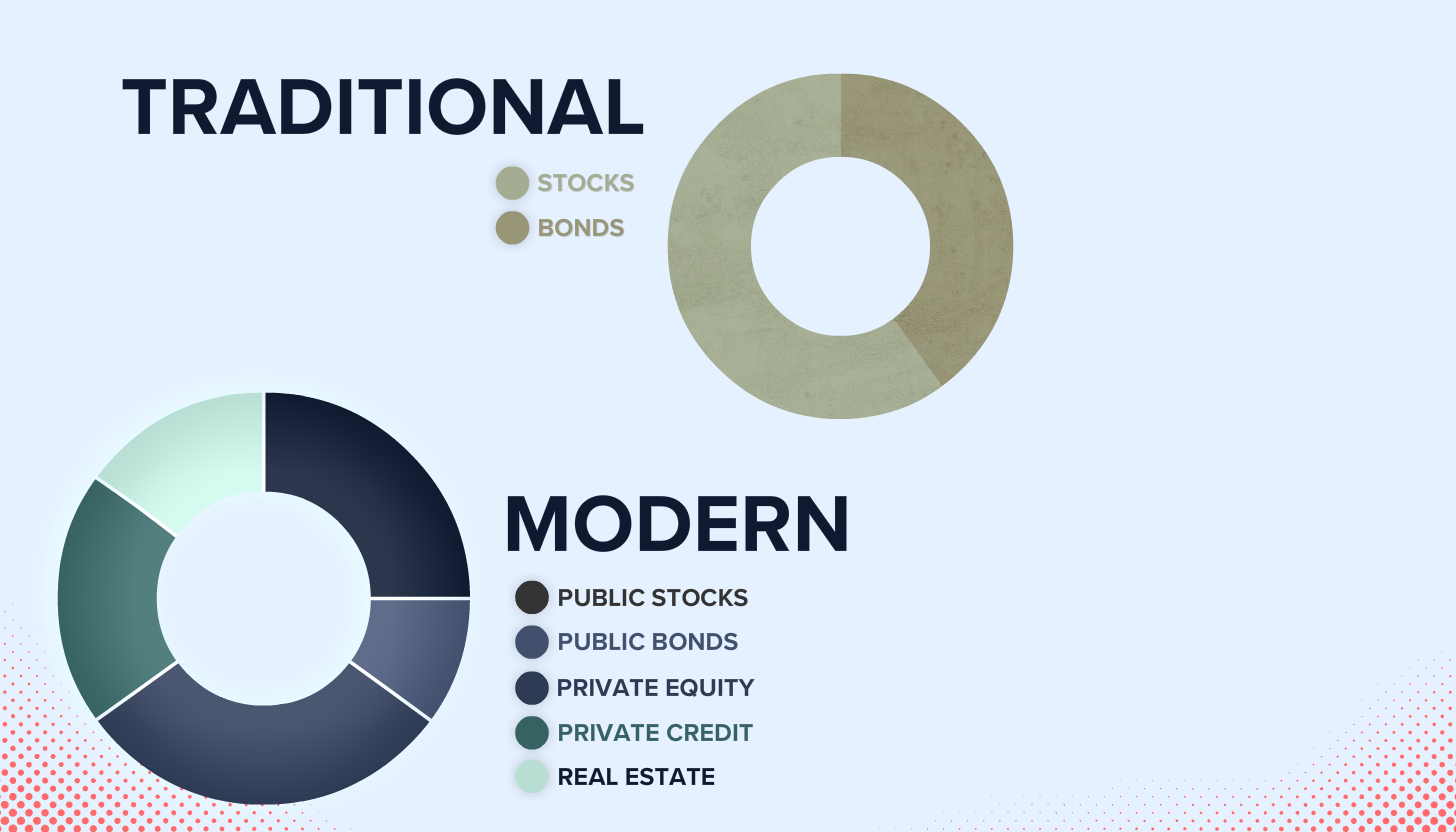

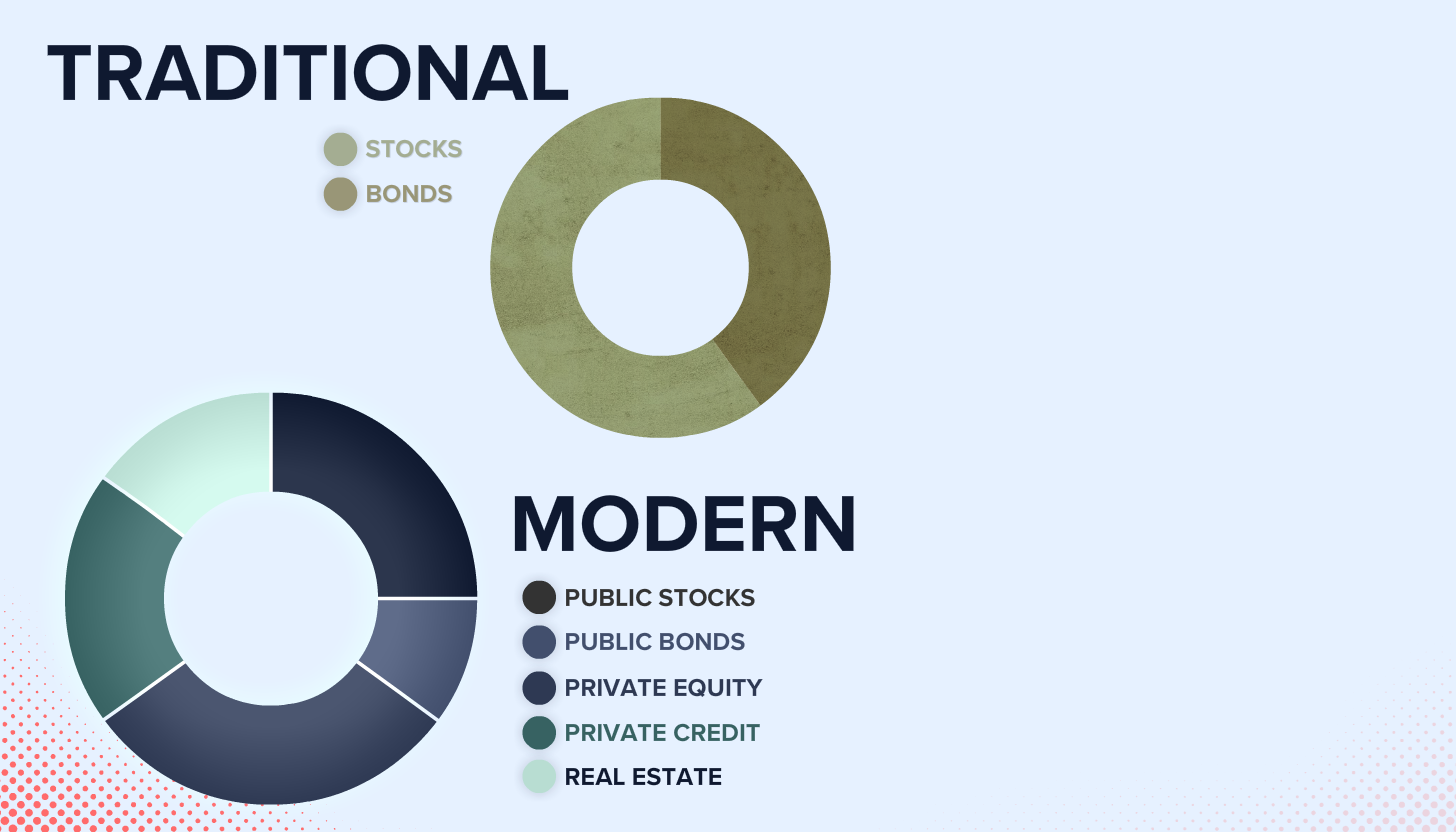

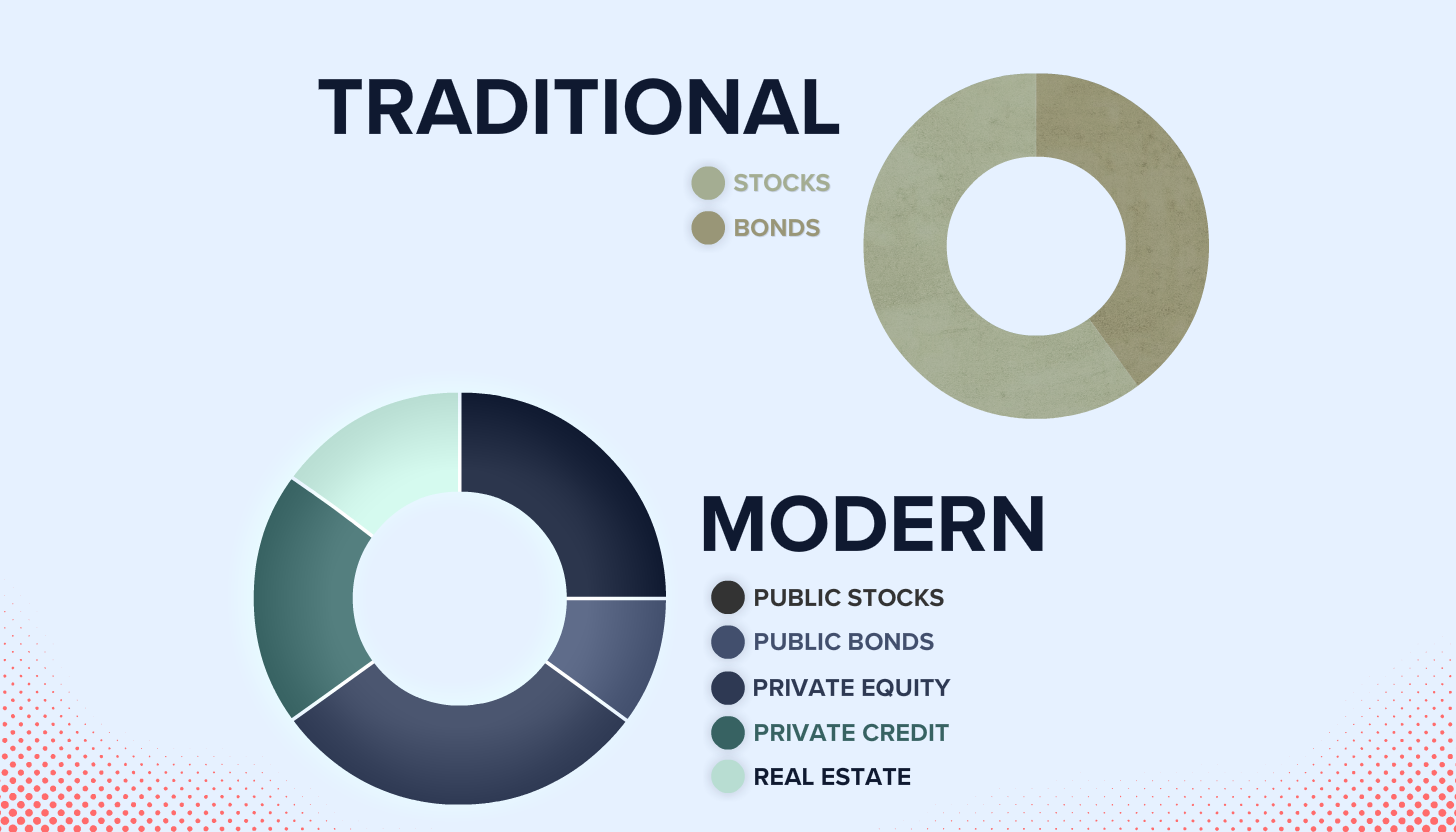

Our pension-style investment philosophy is a necessity in today's market. By embracing a broader spectrum of diversified assets, we offer stability and resilience that the outdated 60/40 model portfolio can no longer provide.

This modern approach aligns perfectly with today's economy, mirroring the strategies of 'smart money' - the tactics used by the world's wealthiest families, largest pension funds and endowments. It's a strategy proven to weather market volatilities while seeking growth.

With Longevity, you're not just investing; you're embracing a future-proof strategy. A strategy that's as robust as it is rewarding, designed to secure a financial future that fits the realities of the 21st century.

At Longevity, our approach to investing marks a clear departure from the past.

Our pension-style investment philosophy is a necessity in today's market. By embracing a broader spectrum of diversified assets, we offer stability and resilience that the outdated 60/40 model portfolio can no longer provide.

This modern approach aligns perfectly with today's economy, mirroring the strategies of 'smart money' - the tactics used by the world's wealthiest families, largest pension funds and endowments. It's a strategy proven to weather market volatilities while seeking growth.

With Longevity, you're not just investing; you're embracing a future-proof strategy. A strategy that's as robust as it is rewarding, designed to secure a financial future that fits the realities of the 21st century.

THE MODERN

PORTFOLIO

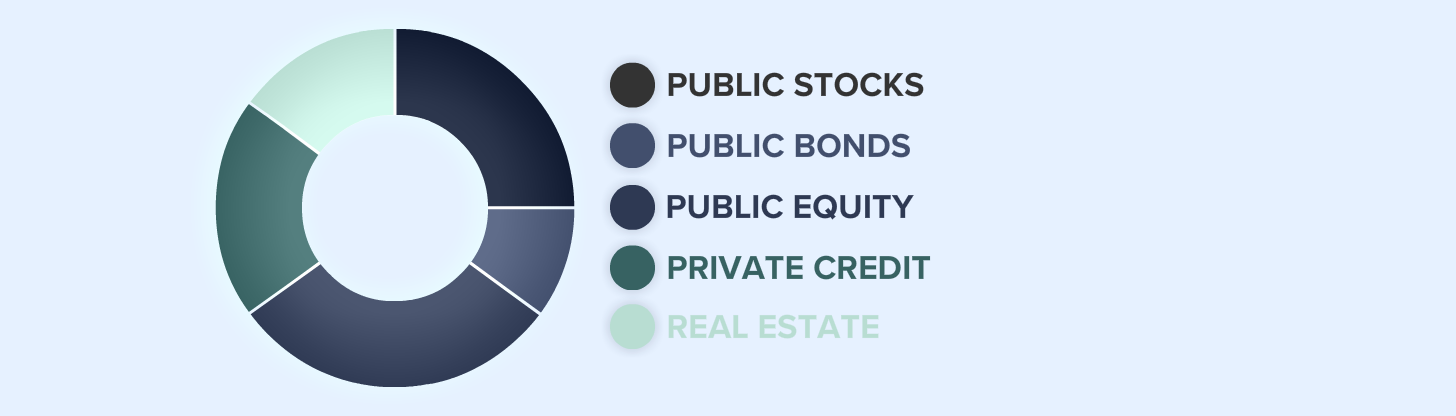

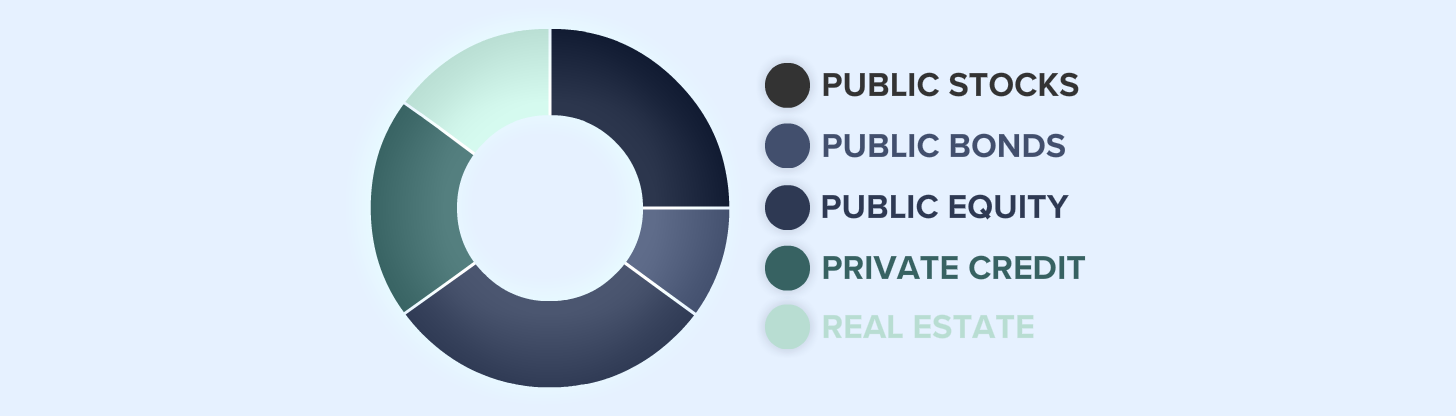

The Modern Portfolio at Longevity redefines investing for today's market. Moving beyond the outdated 60/40 model, our pension-style philosophy embraces a wide range of diversified assets, ensuring stability and resilience. This approach mirrors the proven strategies of 'smart money' used by the world's wealthiest and largest funds. Designed to navigate market volatility and foster growth, it aligns with the realities of today's economy. With Longevity, you're not just investing; you're adopting a robust, future-proof strategy for a secure financial future.

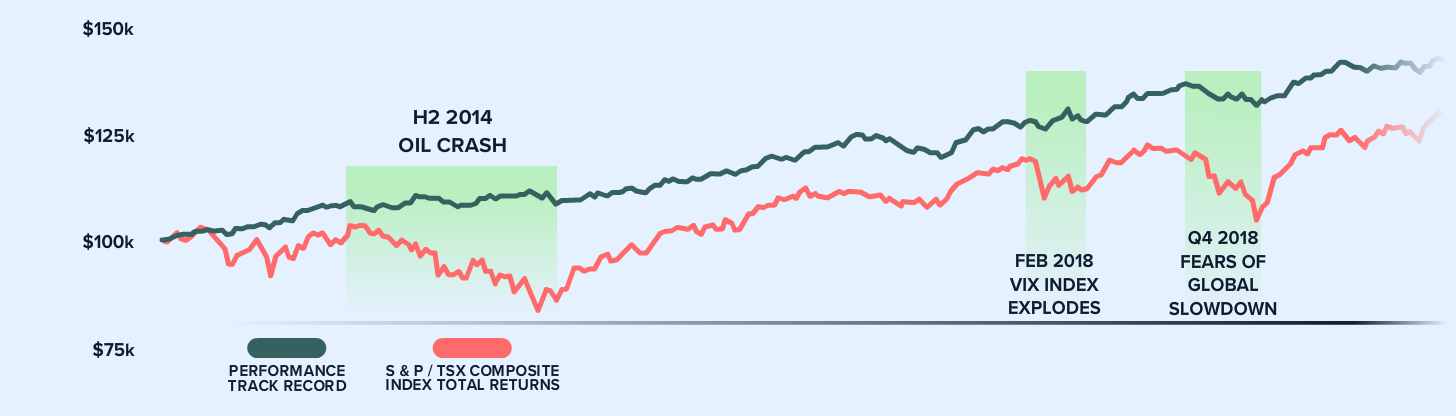

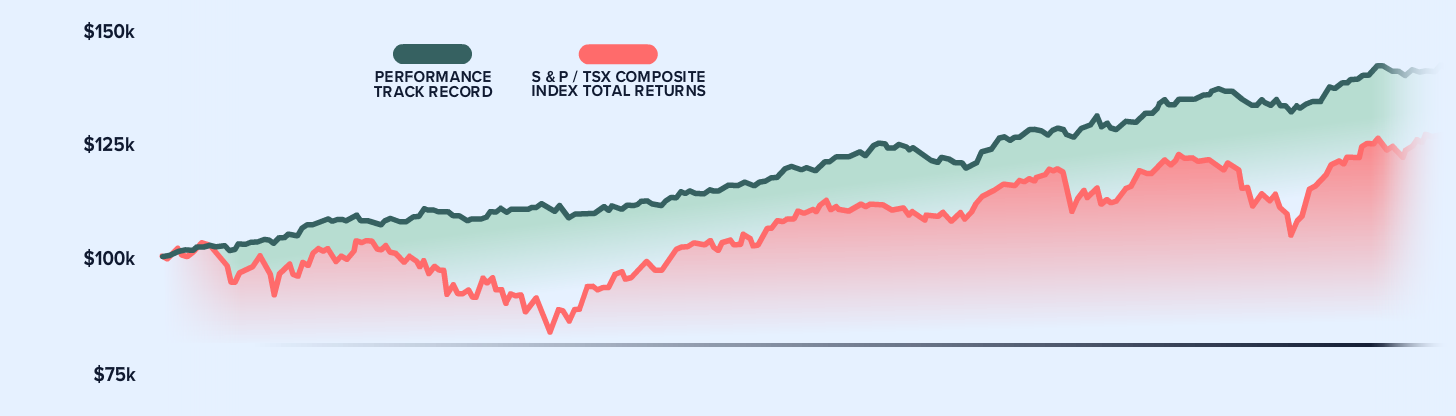

ESCAPE THE VOLATILITY OF PUBLIC MARKETS

In the fluid global economy, traditional diversification strategies have lost their impact. The rise of private equity and decrease in public listings demand a more dynamic investment approach, which Longevity delivers.

EXPAND YOUR INVESTMENT HORIZONS

Longevity expands investment possibilities beyond traditional assets, offering stability and growth potential with a focus on tangible alternatives. This approach diversifies your portfolio and shields it from public market volatility.

ENHANCE YOUR INVESTMENT OPPORTUNITIES

Our partnership with Proof Capital brings a refined selection of investment opportunities, combining their expertise in private markets with our client-focused approach.

Planning Pillars

Blueprint for Success

In collaboration with Proof Capital, we bring to our clients a refined selection of investment opportunities.

Diverse Investment Funds

From the Alternative Income Fund, focused on private credit and direct investments, to the Special Situations Fund, which targets unique market opportunities.

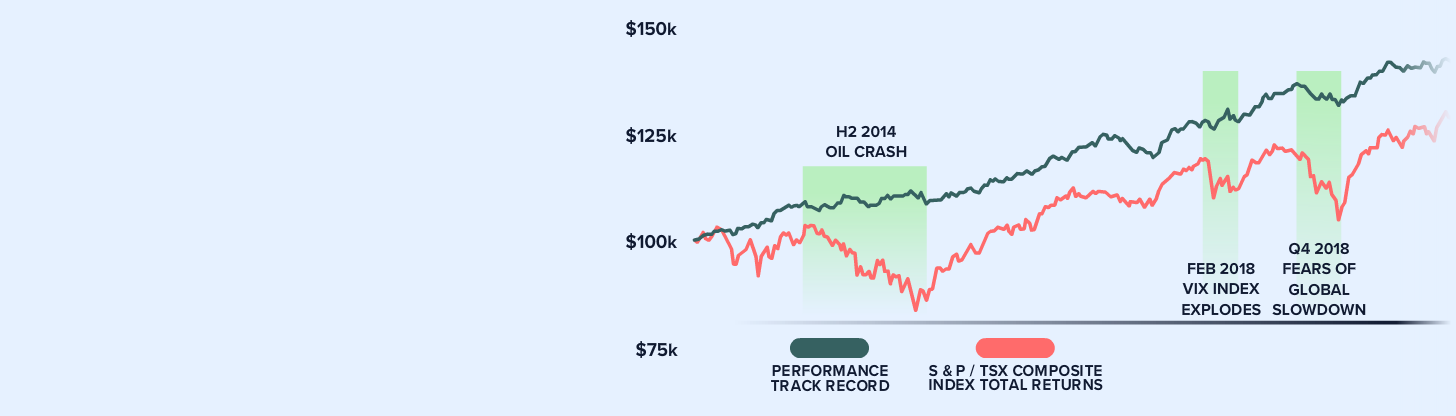

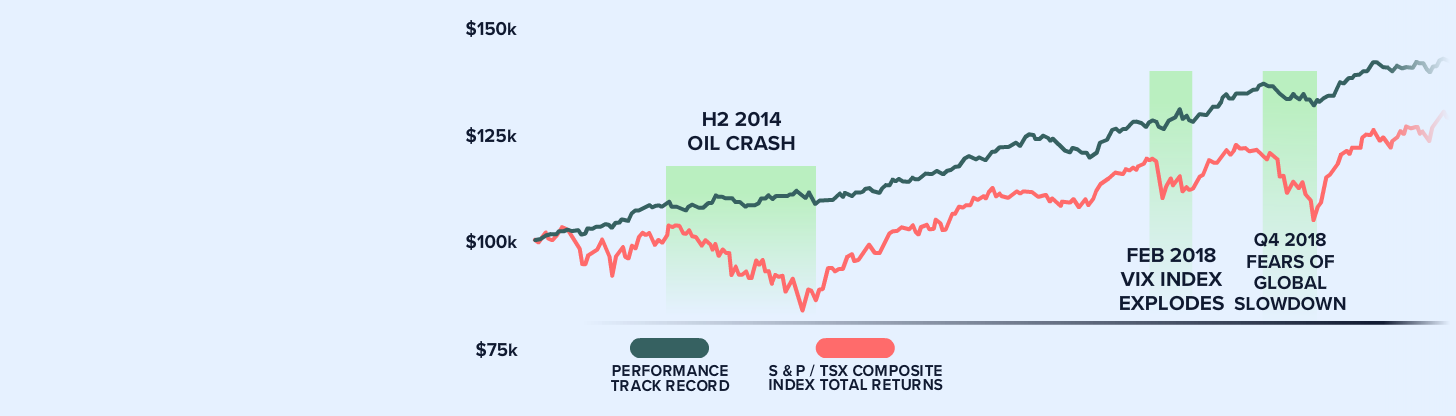

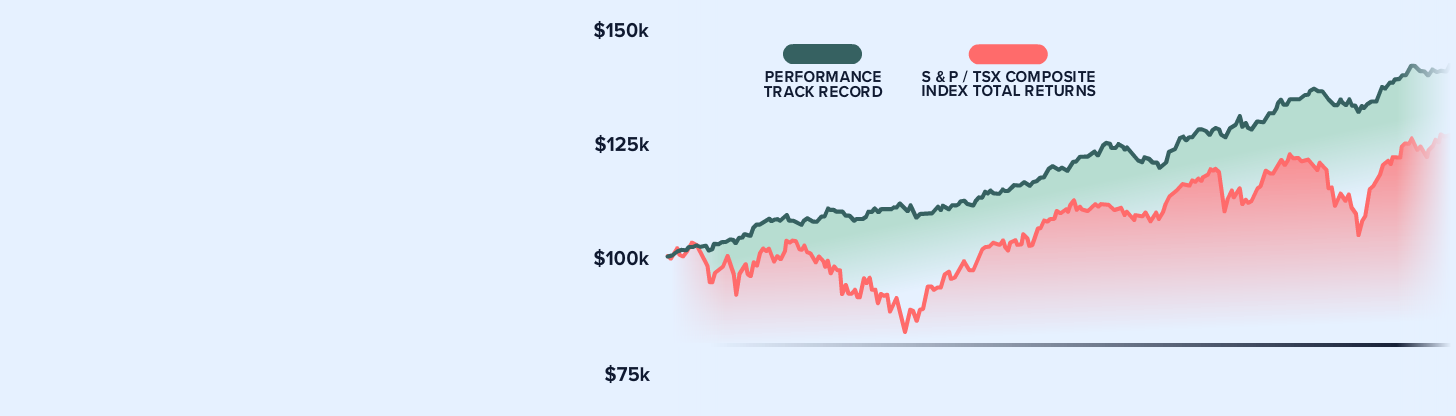

Low Volatility & Wealth Protection

Our investment targets are carefully chosen to provide stability, aiming to protect your wealth from the excess volatility of public markets.

Real Diversification

We believe in the power of tangible alternative assets, which show low correlation with public capital markets, offering true diversification.

Liquidity and Flexibility

Despite focusing on long-term investments, our open-ended fund structure ensures monthly liquidity, aligning with our clients' needs.

Principles for Success

Our investment principles are designed to navigate the complexities of today's financial environment

Invest in Proven Success

Proof Capital targets private investments at the optimal stage — post-proof of concept yet before widespread market access.

Quality and Longevity

Our focus is on long-term, high-quality investments, balanced with the option for monthly liquidity.

Internal Deal Flow

Leveraging our network, we access private, event-driven opportunities that provide unique investment avenues.

Meet Our Investment Team

Led by industry veterans like Jeremy Kaliel and Cameron Reid, our team ensures your investments are managed with skill and foresight.

Jeremy Kaliel

MBA

Portfolio Management

Proof Capital

Cameron Reid

MBA, CFA®

Portfolio Management

Proof Capital